Fixing Customer Account Invoices Paid Off with the Wrong Tender Type

This article explains how to correct a Customer Account invoice that has been paid using the incorrect tender type (for example, paid as Cash instead of Direct Deposit).

Use this solution when:

-

A Customer Account invoice has already been paid

-

The payment was processed using the wrong tender type

-

The invoice amount is correct, but the tender allocation is not

Important Notes

-

Do not delete invoices or payments.

-

Always reference the original audit number to preserve traceability.

-

This process ensures:

-

Financial accuracy

-

Correct tender reporting

-

A clear audit trail for reconciliation

-

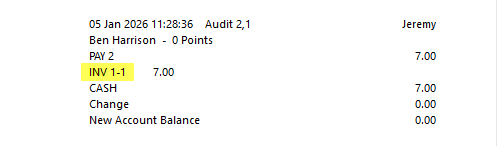

1. Identify the Original Audit Number

-

Locate the audit number of the incorrect payment.

-

This can be found via:

-

Journal History

-

Customer account history

- Write this audit number down, it will be referenced in every corrective step.

-

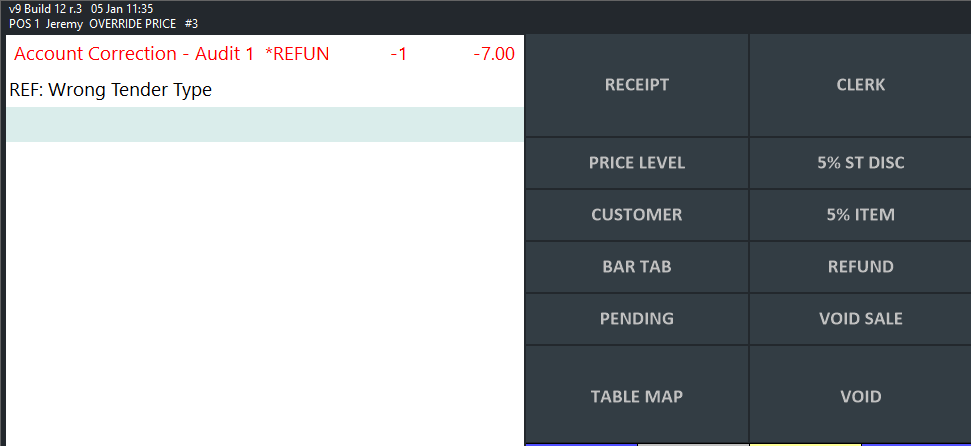

2. Perform a Refund Sale for the Incorrect Payment

-

Create a Refund Sale using an Open Stock Item for the exact value of the accidental payment.

-

Use the same tender type that was incorrectly used.

-

In the reference or notes field, record:

-

The original audit number

-

A brief reason (e.g. “Correction – wrong tender type”)

-

This reverses the original incorrect tender allocation.

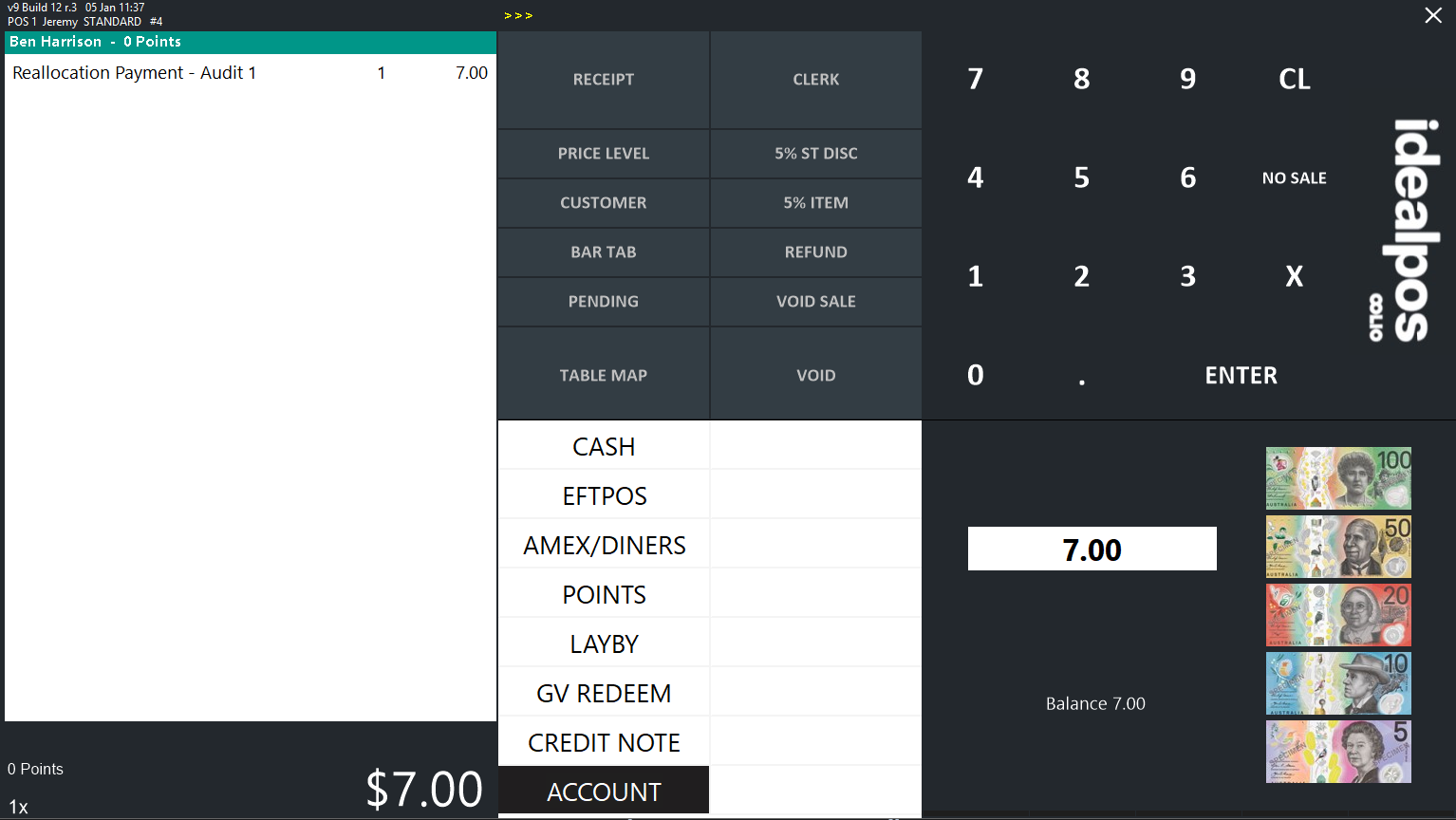

3. Create a New Sale to the Customer Account

-

Start a new sale

-

Add an Open Stock Item

-

Set the value to the required invoice amount

-

Tender the sale to the Customer Account

-

In the reference/notes field, include:

-

The original audit number

-

A note such as “Reallocation of payment”

-

This creates a new unpaid customer invoice.

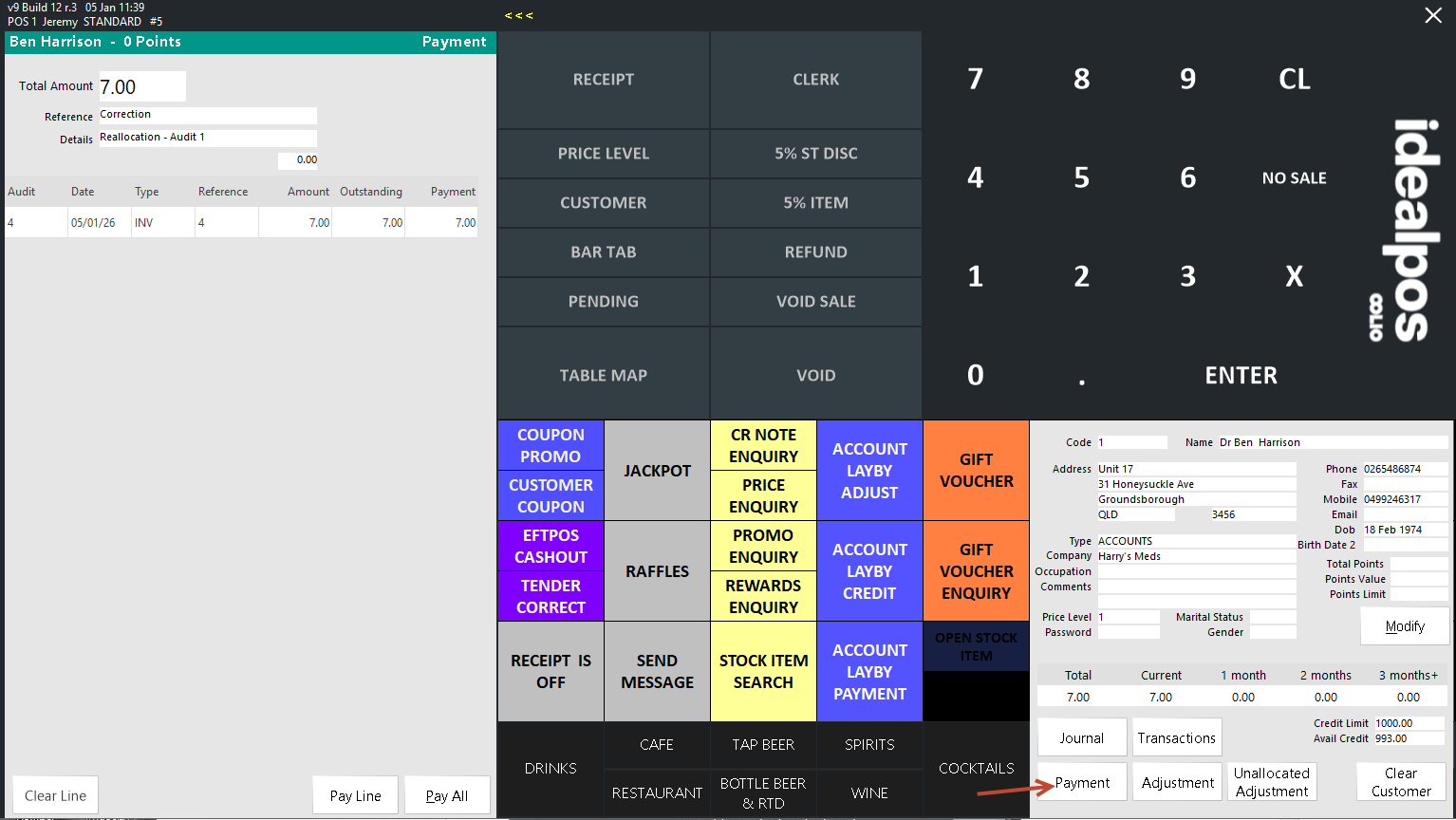

4. Pay Off the New Invoice Using the Correct Tender

-

Locate the newly created customer invoice

-

Pay it off using the correct tender type

-

In the payment reference/notes, record:

-

The original audit number

-

The payment is now correctly reflected against the proper tender.

Result

After completing these steps:

-

The incorrect tender allocation is fully reversed

-

The customer account balance is correct

-

The payment is recorded against the correct tender

-

A complete and transparent audit trail is maintained

Best Practices

-

Always include audit numbers in references for financial corrections

-

If unsure, confirm tender expectations with the customer before reprocessing

-

Document the correction in internal notes for future reconciliation